What Does Accounting Franchise Do?

Table of ContentsAn Unbiased View of Accounting FranchiseThe Best Guide To Accounting FranchiseThe 4-Minute Rule for Accounting FranchiseNot known Factual Statements About Accounting Franchise 10 Simple Techniques For Accounting FranchiseThe Basic Principles Of Accounting Franchise The Best Guide To Accounting Franchise9 Simple Techniques For Accounting Franchise

Therefore, inaccuracy among franchisee accounts also basic mistakes in bookkeeping can be detrimental. Every person and organization is responsible to the IRS. Using an outsourced bookkeeper makes tax obligation time often feared by individuals a breeze. Bookkeepers develop profit and loss files, run-off equilibrium sheets, and cashflow analysis precisely and consistently.In spite of previous experience and an MBA Lee recognized that he did not have the knowledge or rate of interest to manage his economic publications. He explained: "Opening in The Woodlands was the smartest step I ever before made It's the heart and soul of the oil and gas world, and I understood it was just the right place to serve the consumers we intended to reach.

Accounting Franchise Things To Know Before You Buy

"Unlike Lee, however, Tripp found an option: Remote Quality Bookkeeping (RQB). After being introduced to RQB at a business meeting, Tripp hired RQB to manage the bookkeeping and accounting difficulties associated with his franchise.

"They understood the company reporting demands that are unique to Batteries And also franchise owners. That's what it was around. I really didn't have any kind of issues and I swiftly launched with them."Now, Lee and Tripp experience streamlined bookkeeping and have liberty to expand their company and team. "On day one," Tripp reported, RQB experienced our publications from A-to-Z, understood what we have been doing and recognized what we needed to do much better."Both franchise business proprietors experienced company makeover and liberty to pursue areas of true competence with the franchise business bookkeeping services used by RQB.

Accounting Franchise Things To Know Before You Buy

Think about starting a franchise business in bookkeeping. In today's rapid corporate globe, bookkeeping solutions are constantly in demand. Expert financial guidance is essential for both individuals and firms to manage intricate tax needs, manage funds, and make knowledgeable decisions.

Lots of advantages included this approach, such as a pre-established reputation, franchisor support, and an examined company plan. This is a terrific option for accountants that desire to establish their very own company and avoid some of the risks that come with beginning from square one (Accounting Franchise). Here's a step-by-step guide to aid you get going on your trip to running a successful book-keeping franchise business: The initial step in releasing your accountancy franchise business is choosing a franchisor that lines up with your worths, organization objectives, and vision

Accounting Franchise Can Be Fun For Anyone

Consider factors like the franchisor's performance history, training and support they offer, and the first financial investment needed. Check out the franchise arrangement very closely after picking a franchisor. Obtain legal suggestions if needed to guarantee that you understand all the conditions. Confirm that the agreement is equitable and plainly defines each event's responsibilities.

Take into account costs for staffing, advertising and marketing, equipment, lease contracts, franchise charges, and funding. Make a complete budget to make sure you understand specifically what your financial obligations are.

The majority of franchisors use training so that you and your staff are completely accustomed to their systems, accounting software program, and business methods. Furthermore, make sure that you and your group have actually been enlightened on one of the most recent accounting standards and legislations. Use the brand acknowledgment of your franchise business by carrying out effective advertising approaches.

Everything about Accounting Franchise

Use the franchise's help and marketing sources to get in touch with new clients. As you begin your book-keeping franchise, concentrate on constructing a strong client base. Give superb solution and develop strong relationships with your clients. Your reputation and word-of-mouth references will certainly play a critical duty in your company's success. The continuous assistance provided by the franchisor is an important benefit of running an accountancy franchise.

See to it your audit company adheres to all legal and moral laws. When dealing with the economic information of your clients, keep the biggest criteria of confidentiality and stability. Keep updated with market fads and technical improvements in the area of bookkeeping. carry out electronic options and automation to streamline your procedures and provide more value to your clients (Accounting Franchise).running your very own book-keeping franchise organization provides an appealing course for accounting professionals aiming to click here to find out more end up being business owners.

Everything about Accounting Franchise

that make use of an expert tax obligation preparer, such as a tax franchise business, has been consistent over the years. Absence of time and an increasingly difficult tax code are 2 primary reasons that individuals and companies have a tendency to seek outside aid in preparing their tax returns. Consider this: The IRS approximates that it takes 16 hours (including the moment it requires to gather the essential papers) to finish the Form 1040, the private return that almost 70% of Americans make use of.

Tax franchise business can help these individuals and services sort through the complex tax obligation declaring procedure and provide a procedure of peace-of-mind to their consumers. When a private indicators a tax return, it indicates she or he gets on the hook for any kind of questions the government may have also years in the future.

Additionally aiding draw in franchisees to the industry is the variety of solutions that they can use, additionally boosting earnings potential. While tax obligations are the emphasis, numerous tax preparation franchises have actually advanced to additionally help clients in other locations of the market such as: bookkeeping, bookkeeping, payment or payroll services. In enhancement, potential franchisees can choose to focus on a details market.

Our Accounting Franchise PDFs

But when it pertains to discovering the details of an initial financial investment, the franchise disclosure paper is the ideal location to look. Franchisors use itemized quotes in their franchise business disclosure document (FDD) based upon their experience establishing, and in many sites cases operating, systems. Maintain in mind these quotes are just that, thoughan quote.

The advantages of possessing a franchise can be various vs. independent procedure. Right here are a few of the leading advantages for those that decide to have a bookkeeping and monetary solutions franchise business rather than going at it alone. Call Recognition: When it pertains to locating a company to handle their money, people are likely going to intend to take care of somebody they rely on.

How Accounting Franchise can Save You Time, Stress, and Money.

Since they typically don't come with the regular training and ongoing support franchise business supply, business opportunities have a tendency to cost substantially less than franchise business. Simply since it's classified in different ways does not mean that a business opportunity can be any much less productive than a chance classified as a franchise. Both require the purchaser to be committed and tireless to find success.

The best distinct variable between both Our site is how much assistance you desire. If you're merely trying to find a jumpstart and desire a lot more flexibility, an organization opportunity can be the route for you. If you're seeking constant assistance, and can manage more restrictions (or need much more advice) in the procedures of your service, a franchise could be the course for you.

Romeo Miller Then & Now!

Romeo Miller Then & Now! Danny Pintauro Then & Now!

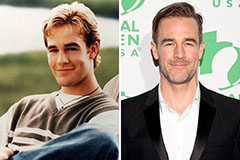

Danny Pintauro Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!